Opportunity Costs

It’s never easy to discover that a product you’ve poured your heart, sweat, and tears into isn’t working out. Startups operate in constant ambiguity, and sometimes you can’t see light at the end of the tunnel after toiling away for what feels like an eternity. Sometimes there simply is no light.

I’ve heard the phrase “Take more market risk when you are young, and more execution risk when you are older.” As I understand it, this suggests that people early in their careers should bet on markets and opportunities, even contrarian ones. I’m reflecting on this because I’ve been thinking deeply about how to best allocate my time and energy on the most promising projects. This isn’t about diversifying—I recognize my limited attention span, and pursuing everything simultaneously leads to burnout and mediocre results. Hence this post: an attempt to provide clarity.

The first sunsetted products - Cogno (Multi-agent Sales Assistant) and Marrrket (AI Enabled Secondhand Marketplace)

The first sunsetted products - Cogno (Multi-agent Sales Assistant) and Marrrket (AI Enabled Secondhand Marketplace)

As AI tools mature, I’ve accelerated my shipping velocity dramatically. However, speed doesn’t guarantee success. Over the past two years, I’ve launched five products: Cogno (Cognogpt.com), Marrrket (Marrrket.com), Crowdlistening (Crowdlistening.com), and A2A Catalog (a2acatalog.com). I also helped ship three 0-1 products: Symphony Assistant (https://ads.tiktok.com/business/copilot/standalone), Insights Spotlight (https://ads.tiktok.com/business/en-US/blog/insights-spotlight-trends-tool), and Aibrary (aibrary.ai). Among these products, some worked, while some didn’t. Some worked, others didn’t. For transparency, I’ll focus only on projects I directly led.

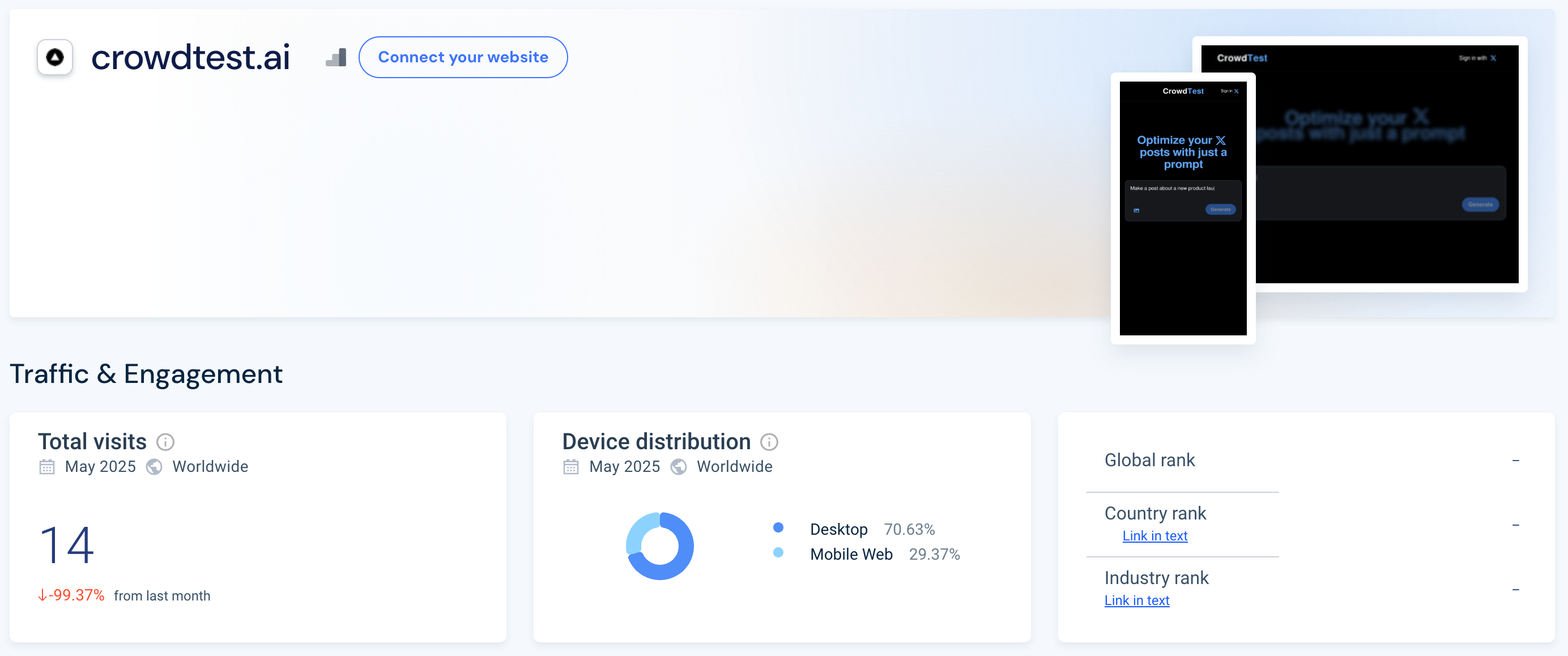

Marketing matters enormously, but converting traffic into revenue remains the critical challenge. Amid AI hype, one differentiation strategy involves controversy and viral marketing, as demonstrated by Cluely. While we await that outcome, Crowdtest.ai offers a retrospective case study. Founded by a freshman with significant Twitter following, Crowdtest.ai claimed $30k revenue within 24 hours of launch (with generous refund policies). Despite initial buzz, it maintained only ~1,500 MAU two months post-launch, with declining metrics since. This wasn’t success—the value proposition remained unclear. Who pays $100 to optimize Twitter posts? Does AI genuinely outperform human intuition here?

Crowdtest.ai - A case study in viral marketing

Crowdtest.ai - A case study in viral marketing

I replicated this approach for Crowdlistening’s predict feature, inspired by a16z’s social simulation investment thesis. The concept of agent-based testing grounds for ideas seemed compelling, but too many hypotheses remained unvalidated. Agents likely represent generalizations of language (as do human crowds), and the willingness-to-pay question persisted. While not my proudest feature launch, it provided valuable learning. Key lessons: build genuine Twitter following and scrutinize marketing claims—data reveals truth.

Early Catalog Products

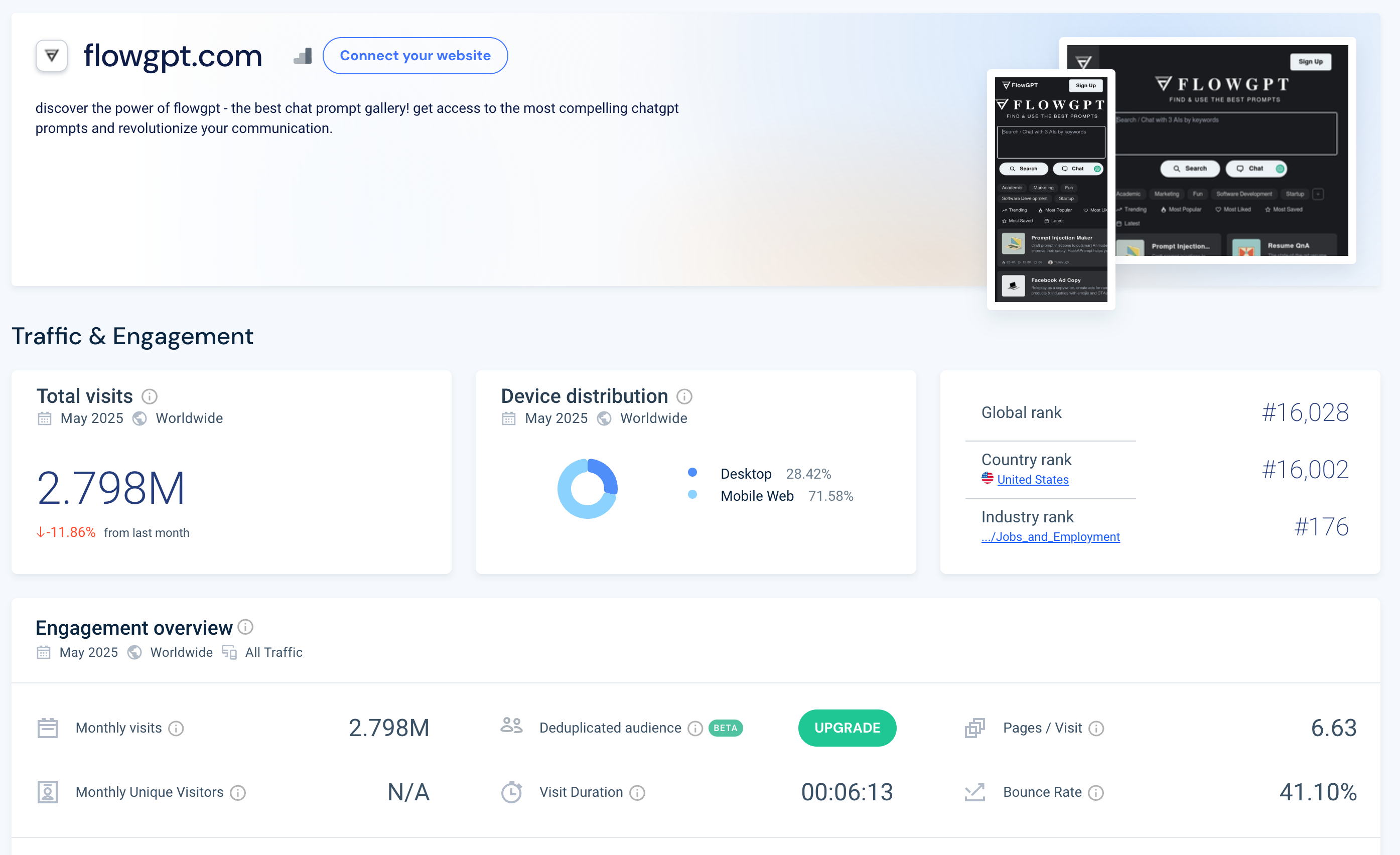

The “app store for everything” phenomenon continues proliferating. FlowGPT exemplifies 2022 success: an early Discord community that evolved into a digital prompt catalog, now perhaps hosting agent experiences. They maintain over two million monthly active users—an impressive achievement. Timing proved crucial: right product, early market entry, sufficient success factors (though monetization remains unclear). Building similar products today faces significantly higher competition given ChatGPT’s November 2022 launch impact.

Website traffic of FlowGPT (June 2025)

Website traffic of FlowGPT (June 2025)

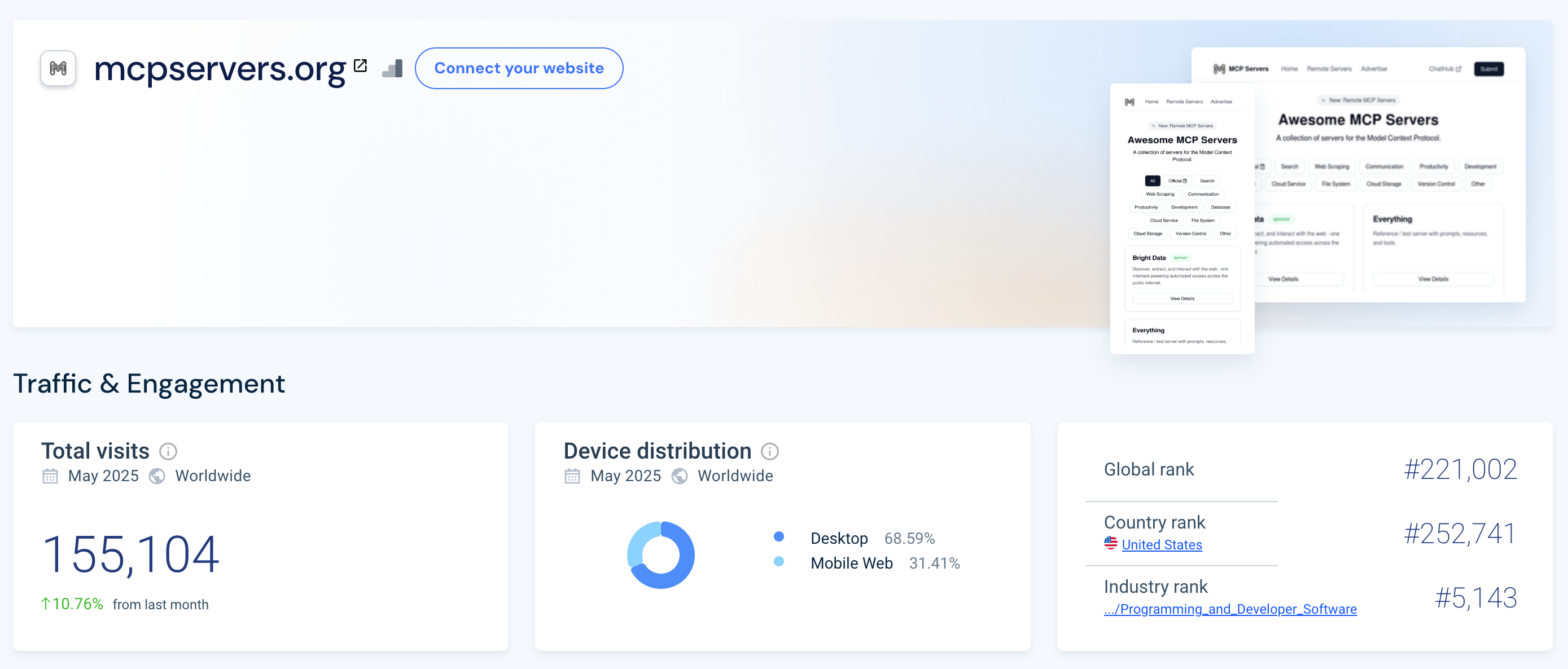

The A2A Agents catalog concept originated from domain name exploration. I sought high-value MCP-related domains, assuming their long-term value, but discovered all premium options were taken. A2A Agents seemed the logical alternative. My reasoning: (1) .com domains retain maximum value, (2) I could compile the web’s most comprehensive A2A Agents directory, and (3) adding MCP Servers would prove easier than adding A2A Agents, given the agent-tool hierarchy. These hypotheses largely hold true, though I underestimated competitive scale and pace. I’ve observed at least five competing catalog websites that, despite lacking premium domain names, have compiled impressive directories.

This remains an active project, but I’ll maintain complete transparency about competitive dynamics. Revisiting my three assumptions: (1) While a2acatalog.com offers excellent branding, domain alone cannot capture and retain users—aggressive SEO optimization and content marketing remain essential (areas where I’m still developing expertise). Alternative channels like TikTok, Reddit, and Twitter seem suboptimal for non-viral content. (2) I can efficiently compile agent and server lists, but so can competitors. If sufficient profit exists, competitors will inevitably crawl catalogs and replicate content. Differentiation must focus on user experience—either simplified deployment for non-technical users or hyper-personalization for technical ones. (3) While I can integrate MCP servers, it’s premature to establish lasting moats, connecting to point two.

MCP Server integration example

MCP Server integration example

I’m curious about catalog product differentiation strategies. I’ve observed websites with 150k+ traffic, though revenue models appear suboptimal. For a2acatalog.com and future products, my goal is either maximum reach or niche vertical dominance enabling consistent revenue streams. The latter requires entering verticals with marketing potential—not general-purpose platforms, but solutions addressing concrete user needs. For maximum reach, significant progress remains necessary.

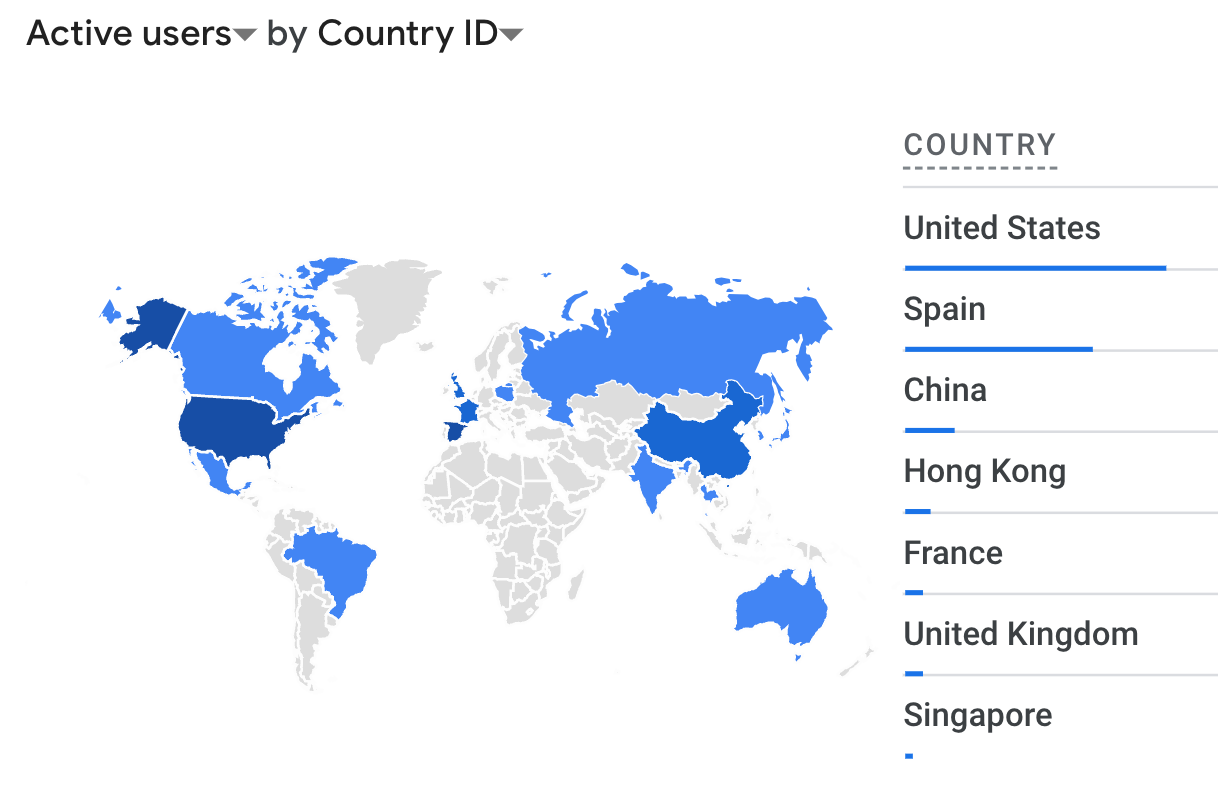

Geographic distribution of catalog users

Geographic distribution of catalog users

Work in progress, thoughts in process. (6.25) Analyzing sunsetted products reveals a pattern: nearly all failed due to customer acquisition challenges. This insight proves illuminating. Successful product launches demonstrate that the best product doesn’t always win—distribution channels do. Perhaps I should prioritize developing distribution channels, using products as traffic capture mechanisms.

Early Products in General

Recently surveying agent products reveals persistent patterns—multi-agent systems for various applications, agentic experiences across domains. As markets have evolved from viewing agents as chatbots (2022) to potential employees, I question whether I should have persisted with certain projects and how to rapidly test ideas for advancing domain understanding.

[ Reusing a Previous Blog Post] Reflecting on 2024 (and 2023 for the context of Cogno), among my list of failed projects, very few failed due to lack of innovation. Since I began working with LLMs in fall 2022, there has been an abundance of interesting GenAI technologies to experiment with. It started with “domain specific prompting/finetuning” and data flywheels (thou not even now does anyone know what this looks like in action). By spring 2023, the focus shifted to LLMs as agents, exemplified by the Generative Agents paper, Microsoft AutoGen, and a few opensource projects like MetaGPT. At Cogno, we also built multi-agent systems, integrating various function calling features and agent collaboration for complex task reasoning. Everyone built, few created value (Glean focused on enterprise search, while Moveworks created value through api actions, neither of which I believe agents to have mattered). Founders encouraged each other’s enthusiasm, while investors rushed to learn the latest buzzwords in LLM technology (‘prompt engineering’ and ‘function calls’ sounded less sexy compared to’agents’).

Being first to market rarely matters - people won’t remember you. What matters is creating defensible moats or developing critical elements that lead to unfair advantages. While Google’s technology investment in Android can be considered ’not just building a moat, but scorching the earth for 250 miles around the castle,’ most companies’ self-described technological differentiation is merely self-flattery and a feeble attempt to impress tech-enthusiast investors. Technology truly matters only when it can solve seemingly insurmountable challenges or optimize costs and operations. In every other situation, the focus should be on building sustainable advantages that ensure long-term survival. [Thoughts WIP]

Thoughts Going Forward

I’m intrigued by results-based monetization models. We began with tokens (chat products)—measuring LLM word output—then shifted to conversations (Copilot) as intent interpretation and generation quality improved. Next evolution: charging based on results? Exa and Sierra are already proposing this, though significant improvements remain necessary. What happens when heavily filtered queries return no results? Extensive compute goes uncompensated—is this sustainable? Similarly, for MCPs and A2As, when users engage with agents through third-party clients, who receives payment? An interesting market system awaits development here.